The Lincoln Avenue Capital team donates diapers to residents in South Florida to help during the Covid-19 pandemic. Photo courtesy of Lincoln Avenue Capital

The Lincoln Avenue Capital team donates diapers to residents in South Florida to help during the Covid-19 pandemic. Photo courtesy of Lincoln Avenue Capital

Historically, the popular perception of people who buy up housing developments for low income renters is not often favorable. Picture the faceless slumlord who lines his pockets while he allows his poverty-stricken tenants to live in squalor.

But at the Santa Monica-based company Lincoln Avenue Capital (LAC), founders Eli and Jeremy Bronfman are trying to develop and promote their new vision for developers of affordable housing — a vision built around improving tenants’ lives and, by extension, impacting communities. That philosophy was a significant part of what sold Oren Gabriel on LAC when he joined as the company’s director of strategy and operations in 2019.

“Philanthropy and tikkun olam can come in so many different ways,” Gabriel told the Journal. “I know the Bronfman family has given a lot of philanthropic dollars to a lot of different causes. I kind of look at this as a new model, where Jeremy and Eli and our team are taking a more scalable and sustainable approach to tikkun olam and to an issue that I think will be one of the biggest of our generation.”

Industry watchers say the numbers bear this out. According to data collected by the National Low Income Housing Coalition (NLIHC), the United States has a shortage of 7 million rental homes that would be considered affordable and available to extremely low-income renters — people living at or below the poverty line. For every 100 extremely low-income renter households, there are 36 affordable and available homes.

This holds true across the country. As the organization highlights every year in its Gap Report, there is no state with an adequate supply of affordable rental housing. West Virginia’s gap is the smallest in the nation, with 62 units for every 100 people. In California, the dearth is much larger at 23 per 100.

“Most of these renters are either in the labor force or they’re seniors or people with disabilities,” said Adam Aurand, vice president of research for the NLIHC and one of the authors of the annual Gap Report. “When you break it down, you can see how the demographics of these families sort of explain their situations. So many of the workers are working in low-wage jobs that just don’t pay enough for their full-time employees to afford housing in their areas.”

The United States has a shortage of 7 million rental homes that would be considered affordable and available to extremely low-income renters — people living at or below the poverty line. For every 100 extremely low-income renter households, there are 36 affordable and available homes.

On May 28, the NLIHC published a report on the importance of preserving units that can be used for low-income housing. Much of the existing stock of housing often used for low-income occupants is older and often not in good shape. Developers who buy these properties, if they choose to do renovations, often bump up the rental prices, making them no longer affordable to low-income men and women.

“When affordability restrictions expire, how do we get owners to keep their units affordable either through reinvesting in the property, through tax credits or some other mechanism?” Aurand said. “We have such a big shortage that we can’t afford to lose any of the stock we have.”

Those kinds of challenges are precisely what LAC embraces. New though it may still be to the arena, the company views itself as a disruptor — a business that can forge strategic community partnerships, create opportunities, be financially viable and also effect positive social impact in the communities it enters. Given how much of an impact the company has already made, their slogan “investing in our communities” seems apt.

The LAC impact can take the form of dispatching members of the company’s resident services team to the site to get a feel for the types of services the residents and the surrounding community may need and connecting them with resources. In Florida, home to several LAC communities, the company offers a program that gives financial assistance to long-term tenants when they leave to become first-time homebuyers.

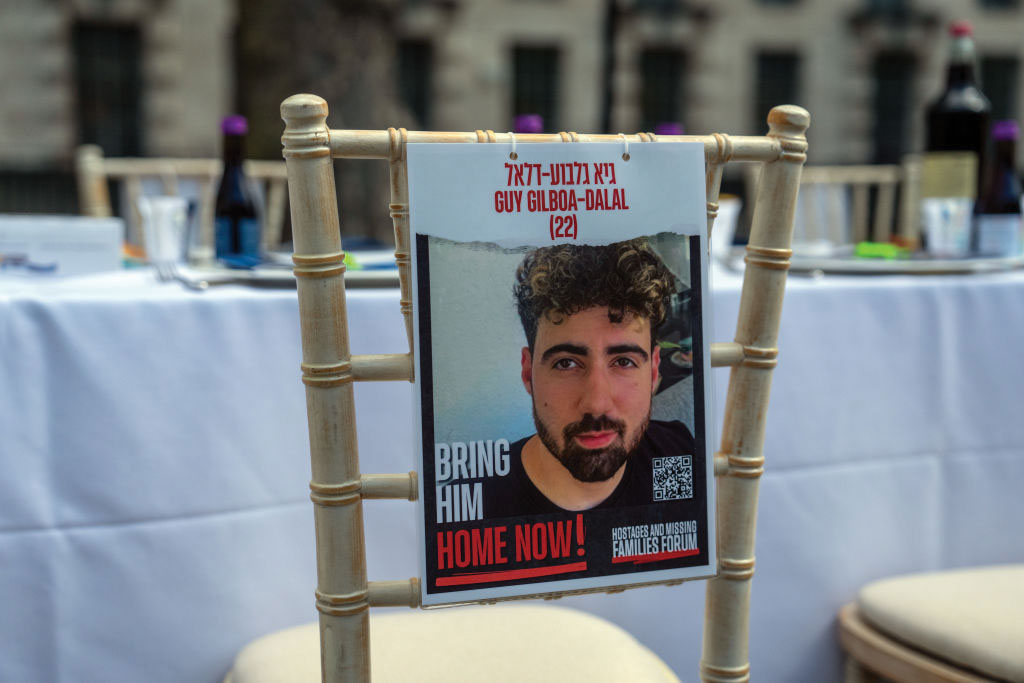

Since the onset of the COVID-19 pandemic, the team has sought out more creative ways to be helpful. In Miami and Orlando, Fla., the company bought 10,000 pounds of fresh produce from a local grower, which they donated to residents. They also have given large quantities of diapers, hand sanitizers and personal protective equipment to the majority of their properties.

“We think that by doing right by your tenants provides you a better tenant base, and the better the tenant base, the better they take care of your building and the more they care about the community,” Eli Bronfman said.

The brothers “gathered” separately for a Zoom interview with the Journal. Although they both grew up in New York City and maintain a New York office, they moved LAC to Santa Monica in the fall of 2017. The move was a homecoming for Jeremy’s wife, Stephanie, whom he met as an undergraduate at Stanford. The West Coast time zone suits Jeremy, who professes he likes working early hours. In addition, the competition for financial talent on the East Coast is higher.

“We found that the overlap of financial talent and people who care about having an impact, there was a little bit more out here,” Jeremy Bronfman said. “We still go back and forth to New York a lot and Florida is our biggest market, but we really do think there’s a shift from an Atlantic-driven economy to a Pacific-driven economy over time. So being ahead of that is something that I’m excited about.”

“So many of the workers are working in low-wage jobs that just don’t pay enough for their full-time employees to afford housing in their areas.” — Adam Aurand

Since its establishment by the brothers in 2016, LAC has acquired 50 properties in 10 states, accounting for more than 9,000 units that house 30,000 residents. Their hope is to shoot past 100 properties by 2021. “It’s become a pretty meaningful business,” Jeremy said, “both from a financial and an impact perspective.”

And if those two outcomes are to be associated with members of the Bronfman family, it certainly wouldn’t be the first time. From family patriarch Samuel Bronfman, who built an empire on the Seagram distillery, to Eli and Jeremy’s father, Matthew Bronfman, the main shareholder in IKEA Israel and Shufersal, multiple generations of Bronfmans have worked across a variety of industries in the United States and Canada and have, in the process, given hundreds of millions of dollars to Jewish causes around the world.

Jeremy and Eli have worked with their family’s office, but through LAC they also want to forge their own path.

“I think it’s important for Jeremy and I to build a business that is distinct from the broader family, that has significant support and affiliation with the family and my father’s financial resources but that really stands on its own two feet,” Eli said.

As the oldest sons of Matthew Bronfman and the grandsons of Edgar M. Bronfman Sr., Eli and Jeremy witnessed the financial success and philanthropic activities of their families from an early age. Whether they were attending an event at the 92nd Street Y, learning about the Shoah Foundation or hearing about the activities of the World Jewish Congress (WJC), they found that philanthropy and the values of tikkun olam were ever-present “I really didn’t know any different,” Eli said. “I thought that’s what everyone did.”

As a high school student, Jeremy recalls Thursday night dinners with his grandfather (“we called them chili night”), during which Jeremy would hear about the work of the WJC, which Edgar M. Bronfman Sr. led for 28 years. As the longtime president of Seagram’s, Edgar Bronfman was financially successful and generous, but Jeremy said he recognized his grandfather’s contributions in different ways.

“In my opinion, the majority of his impact came from his political work at the World Jewish Congress rather than just writing a check,” he said. “That was both with regards to the rights of Jews to leave the former Soviet Union and the Swiss bank reparations. Obviously, his philanthropic work with Hillel was very impactful as well.

“Now that I reflect on Lincoln Avenue Capital, it makes me proud we are having such a big impact not just by writing a check, but through other means,” he continued. “[Edgar Bronfman Sr.] had more resources than Eli and I do, and even with those large resources, he was able to magnify that impact through political and business work. That was really inspiring for me with regards to what we’re doing now.”

“We think that by doing right by your tenants provides you a better tenant base, and the better the tenant base, the better they take care of your building and the more they care about the community,” Eli Bronfman

Eli also cites a recent set of kudos that the brothers received from another prominent family member: their great-aunt — Edgar Sr.’s sister — Phyllis Bronfman Lambert, one of the most prominent conservationists, preservationists and philanthropists in the architectural community in Canada.

“We were talking about what we were doing and she sent me an email in which she said, ‘I’m very proud of what you and Jeremy are doing and I’d like to learn more about how you do it,’” Eli said. “Coming from Phyllis, that someone like her would be so proud of what we’re doing, that’s why we started this business.”

Both brothers had previously worked in various branches of finance; Jeremy in hedge funds, private equity and running a computer software company, and Eli with Goldman Sachs and serving on the equities team at Ice Farm Capital and Arrow Capital. The death of their grandfather in 2013 inspired the brothers to work for the Bronfman Family Office, which provides growth capital and liquidity to entrepreneur and family-owned businesses in North America and Europe.

When a friend pitched him the idea of bidding on an affordable housing project, Jeremy found the prospect complicated yet intriguing.

“I really didn’t know anything about the industry, but for a variety of reasons, the deal piqued my interest,” he said. “I thought there would be a positive impact and attractive financial returns. Then we started looking for the right team so we could put together our own affordable housing business, scale it up and build what has become a pretty meaningful business from both a financial and an impact perspective.”

Aligned though they are on the mission of their company, the brothers describe themselves as different personalities who are able to take a “divide and conquer” approach to working together. Eli, the company’s managing partner, is often the one seeking out the properties while CEO and managing partner Jeremy figures out how to put the deal together.

“There’s a little bit of a yin and yang to them,” said fellow LAC partner and managing director Yoni Gruskin. “They’re both incredibly smart and they both have a strong drive to succeed in whatever it is they’re applying themselves to, but they go about it in slightly different ways. Jeremy is the guy who can do obscure mental math in his head and Eli is the kind of guy who won’t sleep until things are done exactly the right way to make sure we’re building the organization in a sustainable way and making sure we’re looking at every single opportunity.”

In assembling their team, the Bronfmans gathered a mix of industry veterans and individuals who previously had little or no experience in the housing arena. The brothers said they benefit from the diversity and from the range of personal and professional experiences that their staff members bring.

Gruskin, who has been with LAC since the outset, is one of the employees who came to the business with some knowledge and experience in the industry. Having served as an affordable housing analyst in the New York area before helping launch LAC, Gruskin could see immediately that the Bronfmans were looking to take a different approach. According to Gruskin, many of the people who have worked in affordable housing have been in place since the late 1980s and early 1990s. That entrenchment doesn’t necessarily fuel creativity.

“There hasn’t been a lot of competition or a need to innovate,” Gruskin said. “Jeremy and Eli felt that by outworking the competition and also bringing in a group with different backgrounds, we would be able to come up with strategies and executions that would allow us to truly innovate the industry. We don’t look at this as just a staid set approach to investing or doing development deals. We really try to push the envelope, ask questions and understand if there are new and unique ways to structure deals.”

The proof is in the properties, which many residents say are unrecognizable from what they once were after undergoing improvements at the hands of LAC. In Jacksonville, Fla., the Monaco Arms apartments are nearing the end of their rehabilitation that saw the company spend $36,000 per unit of a 156-unit Section 8 development.

“That’s significant,” said Mark Hendrickson, financial adviser to the Jacksonville Housing Finance Authority, which funded a $16 million bond to acquire the property. “You basically had an almost 50-year old Section 8 family development, and oftentimes those are not in very good condition. Sleazy developers buy old Section 8 deals and they don’t fix them up. People are willing to live there because of the rent structure even if the place is a dump.

“You don’t want to be involved with that,” Hendrickson continued. “You want financing where there is a substantial difference being made in what’s being done to the units so they end up significantly improved from a physical standpoint so you’re not only improving the development, but it’s part of a neighborhood revitalization as well. This deal fits into that category.”

Gruskin and Jeremy Bronfman point with particular pride to the Spanish Park Apartments, a 350-unit complex in Arlington, Texas, that LAC acquired in 2019 after working out a property tax exemption with the City of Arlington. By structuring the deal such that the Arlington Housing Finance Corp. owns the land, LAC does not have to pay property tax. As a result, the company is doing a more substantial renovation than it might otherwise be able to do.

“We think that by doing right by your tenants provides you a better tenant base, and the better the tenant base, the better they take care of your building and the more they care about the community,” Eli Bronfman

The property was not in great shape when LAC put in a bid and the city had tried to work with other partners on the project before without success. According to Mindy Cochran, executive director of housing for the city, the partnership will end up being beneficial to the developers, to the residents and to the overall community. Gruskin and other LAC officials took input from the Arlington Neighborhood Association and from Mission Arlington, a church and nonprofit that has conducted Bible studies and after-school programs. Mission Arlington administrators ended up writing a letter to the city in support of LAC’s proposal. The rehabilitated and newly christened Paddock at Park Row is scheduled to be completed in late 2020.

“They’re going to rebrand it to really give it a new image so it doesn’t carry the old baggage that Spanish Park had carried for so many years,” Cochran said. “This could be a big lift for the neighborhood as well.”

“Seeing the before and after pictures on that particular project, we are literally transforming the interior units, all the community spaces. We’re adding a lot of amenities and we’re transforming the neighborhood,” Gruskin added. “A project like that was not going to be successful by our taking out our old playbook.”

Community outreach and connecting with area nonprofits is every bit a part of the LAC playbook. Last September, the company hired Victoria Whittaker as the company’s director of resident services. Whittaker — like Gabriel — had not previously worked in affordable housing or finance. But she had experience both in nonprofit work and in education. A classmate of Jeremy’s at Stanford, Whittaker also had grown up in a low-income community in San Bernardino, and was quickly sold on the idea of working for an organization that could make money while also helping communities thrive.

“I started to think about what does it mean to work across sectors,” Whittaker said. “As a preschool teacher, I had families coming to me with all sorts of different needs, whether that be health needs or assistance with their rent. I truly believe that it takes both the public, the private and the government sector to come together to uplift communities.”

Since joining LAC, Whittaker has crossed the country several times, visiting properties in Florida and Nevada, interfacing with community nonprofits and interacting with residents.

Brianna Cambra of the Reno-based nonprofit The Children’s Cabinet, told the Journal she had a positive experience with LAC staff. LAC consulted with the children and family services nonprofit on what sorts of programs and services might be useful for the tenants in their Zephyr Pointe and Whittell Point communities in Reno.

“As they opened up these properties, it was important that they have these conversations and identify resources so they could provide as much information on how to connect their families with things that they need,” said Cambra, quality program manager for early education and development with The Children’s Cabinet. “I think that speaks to a level of wanting to do good and to give back to the community.”

“It’s become a pretty meaningful business, both from a financial and an impact perspective.” — Jeremy Bronfman

Whittaker is especially pleased that the company laid the foundation for its programs and resources even before the COVID-19 pandemic hit. “Jeremy and Eli really wanted to react very quickly and make sure that our property managers were prioritizing the health of our residents,” she said. “My team was able to circulate lists of social service nonprofits that we had been building relationships with so we were able to do some warm handoffs to resources that our residents could use, but then we wanted to give a little deeper. We know that food insecurity is a huge issue for our families right now, so by donating fresh produce we can help create a little more stability for them.”

As they look to the future, the Bronfman brothers say they want their organization to continue to grow and for other developers to use the resources they have put in place and potentially partner with LAC on deals. Having such a foundation in place and setting a precedent for new and equally innovative deals would be more impactful, Eli contends, than “cutting a check.

“With the millennial generation, you’re seeing people moving around more and caring a lot about what they do,” he said. “So, they’re always evaluating, ‘Am I having an impact? Is my job enhancing the greater good?’ We’re seeing a huge number of people who I don’t think would join our organization if we were not mission aligned. That’s becoming so important.”

“I don’t think anybody necessarily expected us to scale the business so quickly or have the impact that it did, which is a nice surprise,” he added. “But it’s so wonderful to be in a business that is so positive.”

Correction: A previous version of this article incorrectly stated that Jeremy Bronfman met his wife, Stephanie in graduate school.

More news and opinions than at a Shabbat dinner, right in your inbox.

More news and opinions than at a Shabbat dinner, right in your inbox.