Photo from Flickr/401kcalculator.org

Photo from Flickr/401kcalculator.org Last week, Republicans did what they always do when they have power: They passed an across-the-board tax cut.

Not a single Democrat voted for the tax reform bill in the Senate or House. That’s a major shift since the 2001 tax cuts under George W. Bush, when 12 Democrats voted for that bill in the Senate, and 28 voted for it in the House.

Last week, Democrats rightly complained about the process, which was perfunctory and messy, complete with handwritten notes in the final Senate version. They wrongly complained about the structure of the tax reform bill, which they said raised taxes on the poor (false) to decrease taxes on the rich. And they hypocritically complained about increases to the deficit — when’s the last time Democrats complained about too much spending?

But it was peculiarly perplexing to watch religious Democrats complain about the tax bill by citing biblical text. Conservatives were high-handedly informed that God mandates higher taxes — that to care for the poor and the orphan, governments were instituted among men.

Rabbi Danya Ruttenberg led the charge, stating on Twitter, “If the Bible is so against systemic solutions to poverty, why is a jubilee year declared that releases people from debt to alleviate intergenerational poverty? What is leket, shikhah, pe’ah, and maaser if not taxes meant to create a safety net for those in need?”

Let’s begin with the bizarre contention that the Bible requires higher taxes. That’s simply untrue. The Bible talks about “taxes” (Hebrew: mas) in the traditional sense in only a few places: Solomon raised taxes, as did his son Rehoboam, with the result that the kingdom of Israel was split in half; Ahasuerus raised taxes at the end of the Book of Esther, a move that isn’t exactly seen as an unmitigated positive in the Talmud. The Torah’s emphasis on tzedakah is about private giving, not about government-enforced giving.

The Torah isn’t a guidebook for government welfare programs. It’s a guidebook for personal goodness.

Now, let’s talk other forms of biblical “taxes.” First, there’s maaser, tithing; Ruttenberg here probably is referring to maaser sheni, which in Deuteronomy 14 is directed toward the Levite, the stranger, the orphan and the widow (maaser is directed toward the priests alone). It applies only in the third and sixth years of the sabbatical cycle, and it’s 10 percent of the produce.

Then there’s shikhah, which occurs when you forget a sheaf in the field; you’re supposed to leave it for the widow and the orphan (Deuteronomy 24:19). That’s a rather de minimis contribution. Leket and pe’ah are referenced in Leviticus 19; leket refers to ears of corn forgotten on the ground, which are to be left there for the poor (again, this is de minimis); pe’ah refers to the corner of your field. The minimum amount for pe’ah is 1/60th of your field.

At best, then, we’re talking about a biblically mandated 11.7 percent of your produce every third and sixth year. Democrats want to maintain the highest tax rates at over 50 percent, if we include state and local taxes.

Finally, there’s shemitta and yovel. Shemitta mandates the waiver of all debts in the seventh year (Deuteronomy 15); yovel restores all land ownership to its original owner in the 50th year (Leviticus 25). Ruttenberg says that these mechanisms were designed to prevent accumulation of wealth. That’s untrue. Actually, they were designed to maintain tribal land ownership, since the Talmud says that yovel applies only when the tribes were living in their prescribed territories. And the rabbis designed an entire system, pruzbul, in order to avoid the impact of yovel and shmitta loans. It turns out that a system that routinely devaluates loans prevents their issuance, thereby harming the poor.

None of this is designed to undercut the notion that the Torah cares about the poor. It most certainly does. But our obligations are personal, not government-created; God wants us to act out of personal desire to help the poor. And not coincidentally, studies show that those who are most religious tend to give the most to charity, not those who point to the Bible in order to justify government cash-grabs.

The Torah isn’t a guidebook for government welfare programs. It’s a guidebook for personal goodness. To turn it into the former is to prevent the cultivation of the latter.

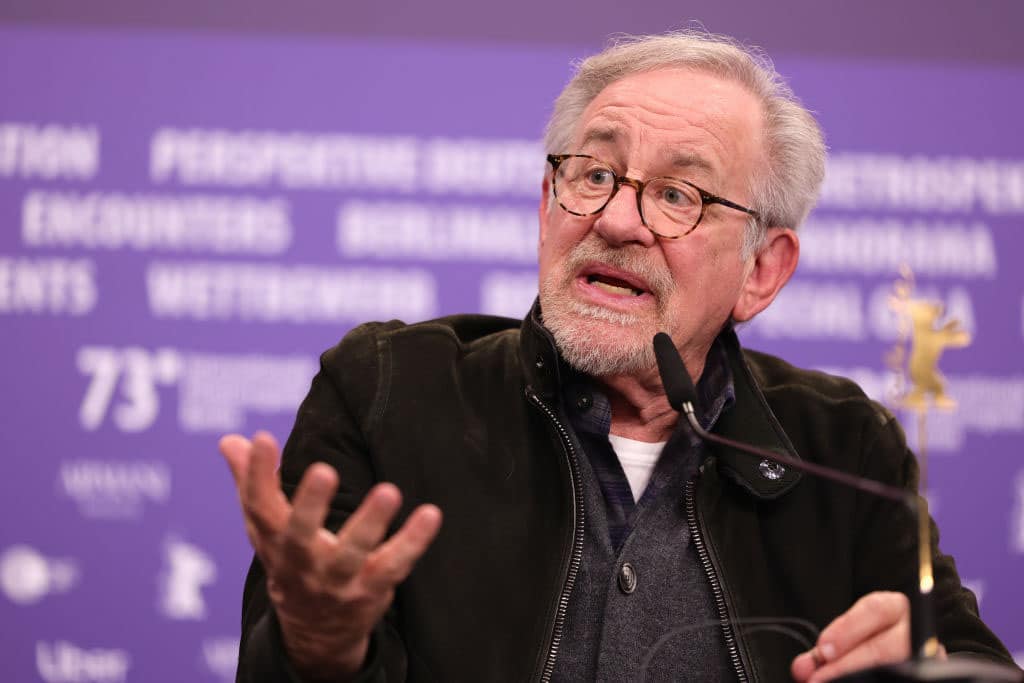

Ben Shapiro is a best-selling author, editor-in-chief at The Daily Wire and host of the conservative podcast “The Ben Shapiro Show.”

More news and opinions than at a Shabbat dinner, right in your inbox.

More news and opinions than at a Shabbat dinner, right in your inbox.