France’s Dangerous Cocktail

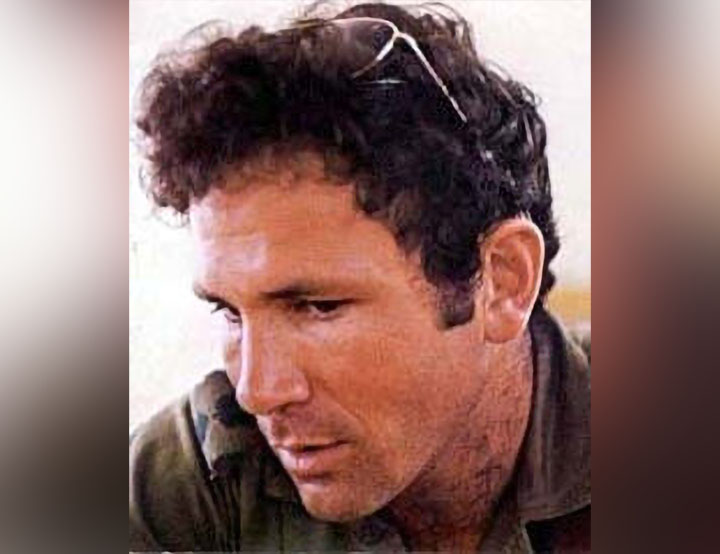

On July 18, Prime Minister Ariel Sharon festively proposed to \”all the Jews of France\” \”to move to Israel immediately … because in France today, one of the wildest forms of anti-Semitism is spreading.\”

Sharon is wrong — not in his concern about a real rise in anti-Semitism in France, but because he explains it too simplistically.

Ten percent of the French population is of Muslim origin. Most are not fundamentalists who feel solidarity with the Hamas suicide bomb campaigns.

More news and opinions than at a Shabbat dinner, right in your inbox.

More news and opinions than at a Shabbat dinner, right in your inbox.