simpson33/Getty Images

simpson33/Getty Images “A young father from La Brea had a heart attack last night,” “We are looking for 40 women to bake challah for a young mother in our community with a sudden and aggressive form of the machala,” “A Breslov Rav went to dip in the mikvah and suddenly passed away,” “A woman known for her unbelievable acts of kindness in the community has suddenly collapsed in the middle of work and passed away.” These are some of the headlines we have been exposed to in recent months. And with each of these horrific stories comes a cry for help in financially assisting those left behind: another Go Fund Me page, another Chesed fund.

With a broken heart, I am writing about the considerable uptick in the number of young people in our communities dying prematurely. We have been hit with one heartrending story after another of families losing a mother or a father at an incredibly young age to heart attack, cancer, car accidents and other horrific tragedies.

Am Yisrael is an amazing nation, with untold sensitivity to one another’s pain and a selfless desire to assist a fellow Jew in need. We are one people, one family, all interconnected and intertwined, who feel immeasurable anguish to the other’s sorrow and want to assist by opening our pockets and hearts.

In this article, I want to highlight the importance of caring for our loved ones while we are still alive and able to ensure their needs are met. My goal is to lessen the burden on the community and to make readers aware of the necessary preparations and planning every head of household should anticipate in taking care of their families. We have an obligation to ensure that our family doesn’t merely survive in case of such an unfortunate event but continues to live with dignity, and proper resources, and not need to rely on the kindness of others.

I am not, Chas V’shalom, suggesting that we do not donate or help; on the contrary, we are Rachamanim B’nei Rachamanim, and we do take care of our own communities. However, there is a delicate balance between caring for ourselves and caring for others. I am suggesting that we take it upon ourselves to do the biggest chesed we can for our loved ones, prepare accordingly, and hope that these preparations and plans remain just that.

We have a mitzvah to provide for the poor and those in need and yet at the same time the Torah explicitly claims, “There shall be no needy among you.” How do we reconcile this apparent contradiction? How do we give charity while simultaneously making sure there are no needy among us? Our commentators interpret that due to the singular form of the verse, “there shall be no needy among you,” the rabbis understood this statement as a reference to the individual: “There shall not be in you a destitute person.” In other words, the Torah commands us to avoid our own poverty. This can be interpreted in different ways. I want to suggest another interpretation—that we should ensure our own financial security even in death. That we should not rely on tzedakah, but rather that we are duty bound to provide for our spouse and children’s future in a way that leaves them with the resources they need to live in dignity.

After an enlightening conversation with multiple community financial advisors, I would like to share some important steps in preparing accordingly:

-

- Financial Planning

Financial planning is an ongoing process that looks at your entire financial picture to help set goals and build a nest fund. Preparing a monthly cash flow via bookkeeping software or Excel will help you plan for what your family needs to cover their costs. How and what are the monthly and annual expenses? What are the family’s sources of income? How much and how is it collected? Have you loaned out cash that a spouse should be aware of? What bills are on autopay? What are your investment portfolios? Other important factors to discuss include access to important sites and passwords.

It is imperative to be organized and have a designated spot for all important documentation. Each spouse should have at least a minimal involvement at the financial level and have a quarterly discussion to go over key players that are part of the family’s team: accountant, attorney, life insurance broker, bankers and how things operate.

-

- Life Insurance/Term Insurance

We all intuitively know we should have life insurance but it seems taboo, or we cannot possibly fathom our impending demise. Other reasons for delaying coverage is not being able to afford insurance or simply not knowing enough about it. There are many affordable plans and structures to get life insurance. There are insurance brokers that can provide insight and answer questions to help find those proper plans for your family. When planning for proper coverage, it’s important to take into account what it costs per child per year and what it will take to care for their needs until 18 years of age or beyond. Factors such as clothes, tuition, medical expenses, weddings and bar/bat mitzvahs should all be taken into account when planning coverage.

-

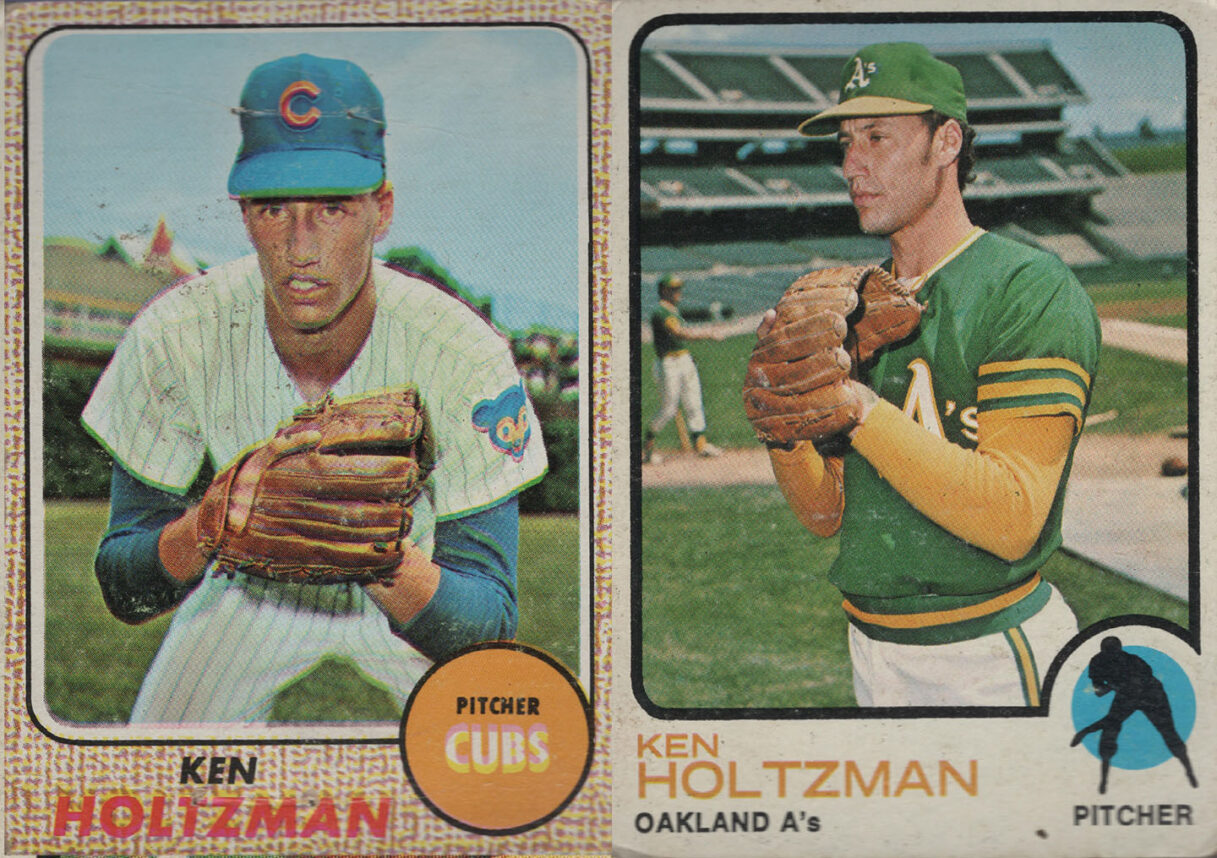

- Living Trusts

A living trust allows you to put into place a last will and testament indicating who will care for your kids and get your assets. If you do not have a living trust, assets will pass into the cumbersome and costly court system. A living trust is a way for your assets to pass seamlessly to your heirs and preserve the privacy of your estate.

An Advance Directive is recommended to appoint someone to make medical decisions consistent with your values when you are unable to and to appoint a power of attorney—a person ready to speak to doctors on your behalf to fulfill your wishes. Lastly, a living trust includes appointing a financial power of attorney who will handle your financial obligations if you can’t.

Toward the end of one of my conversations, a friend mentioned that completing these preparations and plans are the ultimate self-less act. This goes to benefit the family and not the individual. This got me thinking about a different interpretation of chesed shel emet, the ultimate true kindness reserved for taking care of the dead. We know that the kindness that is done with those who pass on is the ultimate act of kindness because there is no possibility that the recipient of the favor will repay the kindness. What if the ultimate chesed shel emet, the ultimate selfless act, is when the deceased does an act of kindness in advance of his passing that the survivors cannot repay?

I am not affiliated with or promoting any life insurance brokers, attorneys, or companies. If anyone needs assistance with a budgeting worksheet you can email me at Leronzaggyrd@gmail.com.

More news and opinions than at a Shabbat dinner, right in your inbox.

More news and opinions than at a Shabbat dinner, right in your inbox.