How Insurance Works

For many families healthcare is increasingly expensive while simultaneously increasingly mediocre. A recent study in the American Journal of Medicine found that two thirds of bankruptcies were due in part to medical expenses, and surprisingly, over three quarters of the individuals going bankrupt had health insurance. There is no denying that the American healthcare marketplace is broken. The problem for many of us is that we don’t know enough history to understand how it broke and we don’t know enough economics to know how to fix it. So we’re left listening to politicians, insurance lobbyists and doctors’ groups each of whom have their own (self-interested) agenda.

I would like in the next few posts to explain how American healthcare got here. The complexity of the problem works to our disadvantage because it makes us reach for any solution without understanding the details, and some of the currently proposed solutions would be even worse than the status quo. (And some solutions have already been tried in other countries or in American states with disappointing results.) Every involved group has a lobby advancing their interests except patients and taxpayers (who are approximately the same people), so it’s hard to imagine a good outcome unless we all accept the difficult burden of democracy: informing ourselves.

The following may be condescendingly obvious to those with a math or economics background, but please bear with me as I try to clarify the details to a broader audience.

Before we start, we have to understand the legitimate purpose of insurance and how it works in settings other than healthcare. That’s the goal of this first post.

To understand the point of insurance, let’s imagine a world in which insurance hasn’t been invented yet. Let’s imagine a city of a million homes and let’s say that the homes average one million dollars in value. Now, occasionally some unforeseen disaster happens – a fire burns a house down. And let’s also assume that this happens on average to one home per year. To the average family in this town this would be financially ruinous. They would be unable to afford rebuilding their home and would lose the lifetime of work that was their equity in their home. Besides the families who are irreversibly impoverished by the actual fire, many other families are very worried that their house could be next.

So one of the town residents, Bob, finds a solution. He realizes that the loss of a house is too big of a loss for any single family to afford, but not for the whole town. So he suggests that the town protect itself by having each family pay $1.50 into a fund every year. That fund would be used to rebuild any house that is lost to fire. Since on average the fund would pay out $1,000,000 every year but would take in $1,500,000 (since a million families are each paying $1.50) there should be extra money left over to pay Bob to handle the administrative work, make a profit, and save for the occasional year that two houses burn down. Thus the first insurance company is born.

The important points to learn here is that the town is losing money on every house it rebuilds, since it’s paying a middleman, Bob, to rebuild the houses. It’s paying a million and a half annually for a million dollar house. Nevertheless, everyone wins, because what each family is purchasing with the extra money that Bob keeps is peace of mind. By collectivizing their risk, they each lose a little money but avoid going broke. That’s the legitimate service that insurance provides: the insurance company takes a risk off your hands and makes a profit for doing so.

The take-home points are that

- Insurance is valuable for events that are both unpredictable and unaffordable.

- Insurance doesn’t make anything cheaper. It makes it more expensive but distributes the cost over many people.

So in general you should never buy insurance against an event that is affordable. For example, buying an extended warranty on a new TV is rarely a good idea. If the TV breaks, most of us could survive without it until we saved up enough to buy a new one. Buying the insurance just means paying extra to buy it through the middleman. Since the company selling you the insurance knows the likelihood that it’ll break (and you don’t) the price of the policy will always be more than enough to cover the risk and make the company a profit. Unless you’ll lose sleep about the event you’re insuring against, that’s a bad deal.

For the same reason, it doesn’t make sense to insure against an event that happens frequently. For example, if the residents in Bob’s town wanted their insurance policy to also pay for their weekly visit from the gardener or to repaint their house every year, they would be foolish. Bob would be happy to sell them such a policy, but would charge them more than the gardener or the painting would cost. It’s much cheaper for each family to pay for predictable costs themselves and only buy insurance for rare and devastating ones.

This is how most insurance works when it works well, and this is how American health insurance worked for a long time. It covered only catastrophes. For everything else, patients paid themselves. Doctors and pharmacists set their prices and patients paid them. Health insurance was relatively inexpensive and was used rarely. Doctors were affordable because they had to be; an unaffordable doctor would have no patients. So how did we end up with health insurance that is both expensive and doesn’t protect people from bankruptcy?

In 1943, with the best of intentions, the old health insurance system was destroyed. Sixty-six years later we are still reeling from the consequences. Next week I’ll explain what happened.

Learn more:

Wall Street Journal Health Blog: ” target=”_blank”>Forward to Part II: How Medical Insurance was Broken >>

” target=”_blank”>Forward to Part IV: A Recipe for Reform >>

Important legal mumbo jumbo:

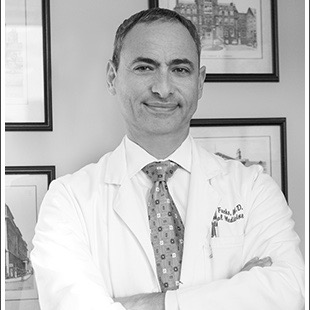

Anything you read on the web should be used to supplement, not replace, your doctor’s advice. Anything that I write is no exception. I’m a doctor, but I’m not your doctor despite the fact that you read or comment on my posts. Leaving a comment on a post is a wonderful way to enter into a discussion with other readers, but I will not respond to comments (just because of time constraints).

More news and opinions than at a Shabbat dinner, right in your inbox.

More news and opinions than at a Shabbat dinner, right in your inbox.