Category

spending

How to spend $24,000 on takeout as prime minister of Israel

$68,000 over two years for makeup and hairstyling. $1,000 in bottle-deposit refunds. $20,000 in cleaning costs.

Congress triples Obama’s request on defense cooperation with Israel

The final version of the congressional defense budget triples the Obama administration’s request for funding for joint U.S.-Israel defense cooperation.

Plan for future pitfalls

Changes in the economy and workforce have taken their toll on baby boomers, a generation that carries a longer life expectancy than its predecessors as well as the financial burdens that come with it.

Monday night vote on ‘cliff’ deal very likely, Sen. Corker says

Republican Senator Bob Corker said it is \”highly likely\” that the U.S. Senate will vote Monday night on a bill to avoid the brunt of the \”fiscal cliff.\”

Editorial Cartoon: The Supreme Court taketh away… and the Supreme Court giveth

GOP candidates push back on cutting aid to Israel

Republican presidential candidates Michele Bachmann and Herman Cain pushed back against a proposal by Ron Paul to cut funding to Israel.

Budget Woes

One year ago, Gov. Gray Davis was calling for across-the-board cuts in every state department except the prisons, mass layoffs of workers and huge bites out of most programs for the disadvantaged.

New Articles

On Counting the Omer

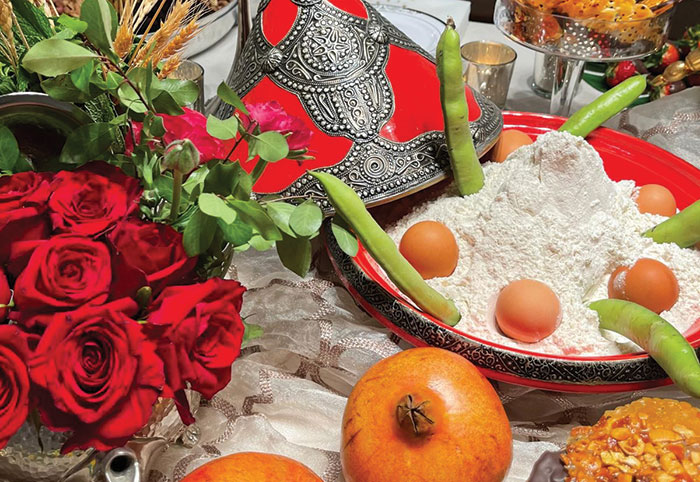

A Memorable Mimouna

Campus Watch April 25, 2024

Will Columbia’s Law School Dean Learn the Law of Free Speech?

More news and opinions than at a Shabbat dinner, right in your inbox.

More news and opinions than at a Shabbat dinner, right in your inbox.