Category

nonprofits

Wake Up and Smell the Automation: Are We Ready to Lose Jobs to Robots?

Liberal groups condemn religion bill as ‘government-sanctioned discrimination’

Some 22 liberal groups, most of them Jewish, condemned a bill that would protect individuals and nonprofits that oppose same-sex marriage on religious grounds from government sanction.

Fight the Minotaur in the Tax Labyrinth

This past September, the Bureau of Jewish Education of Greater Los Angeles, the Zimmer Children\’s Museum and representatives of more than 70 other organizations attended a seminar for nonprofits that I conducted at The Jewish Federation of Greater Los Angeles.

Young Professionals Learn to Lead Pack

Not long ago, Tali Pressman, 24, found herself sitting in a room full of civically minded young Jews in Los Angeles — that elusive demographic of 20- to 30-somethings targeted by so many religious and political recruiters.

The goal: How to better collaborate and organize their diverse work for nonprofits and Jewish communal services in the city.

Federation Faces Underfunded Pension

Faced with a pension shortfall of $20 million, the organized Jewish community\’s largest philanthropy finds itself forced to divert millions of donor dollars to employee retirement benefits, rather than to needed social services.

Jewish Giving is Still Looking Good

When the stock market entered bear territory last month, individual investors weren\’t the only ones taking note. The continued softening of the market can also have a major effect on nonprofit organizations, many of which have benefited greatly from an exceptional run during the past five years.

While it\’s still too early to tell how the recent changes will affect Jewish nonprofits in Los Angeles, fundraisers at some of the city\’s largest philanthropic organizations say they\’re not worried yet.

New Articles

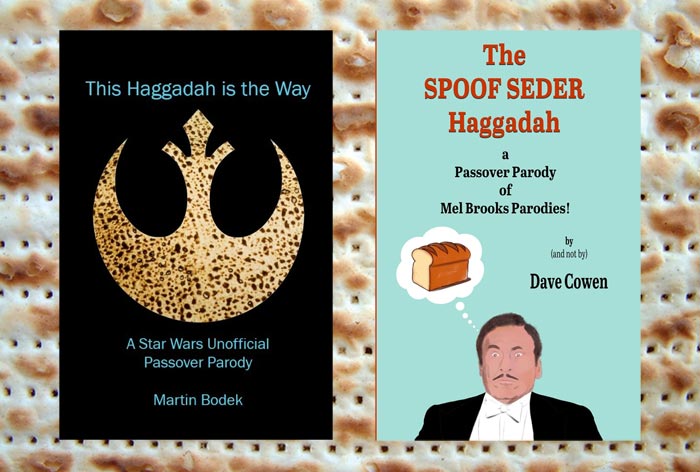

Fun Haggadot for Passover

UC Berkeley Law School Dean Talks About Antisemitism on Campus

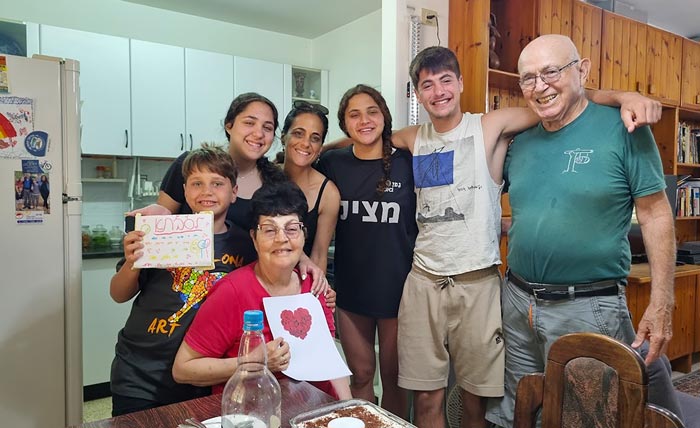

Father’s Captivity in Gaza Spurs Family’s Tireless Advocacy for Hostage Release

Understanding the As-a-Jew Jew

More news and opinions than at a Shabbat dinner, right in your inbox.

More news and opinions than at a Shabbat dinner, right in your inbox.