Category

loans

Congregations offering loans and grants to lure young families

Jewish Journal

February 7, 2011

They were looking to move anyway, said Stephanie Butler. And the $50,000 incentive being offered by Temple Emanu-El in Dothan, Ala., to young Jewish families willing to relocate helped tip the scales. “We never would have looked at Dothan if not for this program,” she said.

Briefs: L.A. Koreans and Jews protest anti-Semitic cartoons published in South Korea;

Jewish Journal

March 2, 2007

Briefs

In Community We Trust

Charlotte Hildebrand

February 15, 2001

Alex Mylyavsky had been in Los Angeles for three months as a refugee from Kiev, Ukraine. He was looking for a job, but it was a vicious cycle: he couldn\’t get a job without experience, but how could he get experience without a job?

New Articles

On Counting the Omer

Rabbi Dr. Stuart Halpern

April 25, 2024

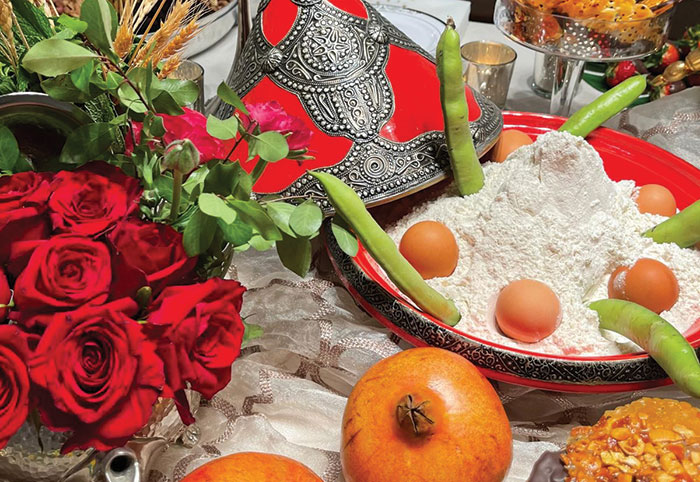

A Memorable Mimouna

Sharon Gomperts and Rachel Emquies Sheff

April 25, 2024

Campus Watch April 25, 2024

Aaron Bandler

April 25, 2024

Will Columbia’s Law School Dean Learn the Law of Free Speech?

Nathan Lewin, JNS

April 25, 2024

Israel’s Defender: The Unstoppable Spokesperson Eylon Levy

Kylie Ora Lobell

April 25, 2024

More news and opinions than at a Shabbat dinner, right in your inbox.

More news and opinions than at a Shabbat dinner, right in your inbox.