Category

finances

When choosing a sleep-away camp, ask (lots of) questions

Jewish Journal

March 16, 2016

Sleep-away camp is a rite of passage.

The roadmap to freedom from debt

Julie Bien

March 12, 2014

JoAnneh Nagler and her husband know firsthand how destructive financial debt can be to a relationship.

For Richer or Poorer

Rebecca R. Kahlenberg

July 12, 2001

It is common to find couples with different, and even conflicting, attitudes toward spending money.

Israel: Land of Sustainable Growth?

Avi Machlis

November 18, 1999

Rosy government forecasts have been backed by a series of recent reports issued by leading financial analysts, who see Israel\’s economy pulling out of the slowdown that has pushed unemployment up to nearly 9 percent since 1997.

Bonding Over Bonds

Beverly Gray

November 18, 1999

Monique Maas Gibbons is co-chair of the Business and Professional Women\’s Division, a branch of the Women\’s Campaign of the United Jewish Fund (and an extension of the Jewish Federation of Greater Los Angeles).

New Articles

On Counting the Omer

Rabbi Dr. Stuart Halpern

April 25, 2024

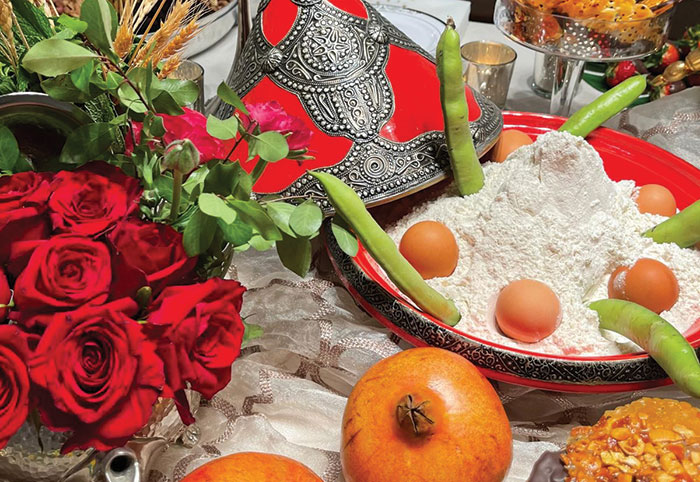

A Memorable Mimouna

Sharon Gomperts and Rachel Emquies Sheff

April 25, 2024

Campus Watch April 25, 2024

Aaron Bandler

April 25, 2024

Will Columbia’s Law School Dean Learn the Law of Free Speech?

Nathan Lewin, JNS

April 25, 2024

Israel’s Defender: The Unstoppable Spokesperson Eylon Levy

Kylie Ora Lobell

April 25, 2024

More news and opinions than at a Shabbat dinner, right in your inbox.

More news and opinions than at a Shabbat dinner, right in your inbox.