Category

currency

Israel warns public on bitcoin risks, mulls regulation

Israel said on Wednesday it was considering regulation of bitcoin and warned citizens that using such decentralized virtual currencies was risky.

Israel’s budget deficit soars

Israel’s budget deficit for 2012 was more than double the government target, coming in at 4.2 percent of Gross Domestic Product (GDP). In addition, debt is 74 percent of GDP, making economic growth in Israel difficult.

Iranian police clash with protesters over currency plunge

Riot police clashed with demonstrators and arrested money changers in Tehran on Wednesday in disturbances over the collapse of the Iranian currency, which has lost 40 percent of its value against the dollar in a week, witnesses said.

Egypt unrest may hasten currency crisis

Violent unrest in Egypt threatens to accelerate the country\’s slide toward a currency crisis, forcing a sharp depreciation of the Egyptian pound in coming months and conceivably prompting Cairo to impose capital controls.

Write ‘Free Palestine’ on currency campaign starts

A new campaign to peacefully promote an independent Palestinian state calls on people to write \”Free Palestine\” on Israeli currency. The campaign was launched on Facebook over the weekend and has gained attention worldwide, according to reports, which say it is likely that \”Free Palestine\” will be written on other countries\’ currencies as well. Israeli shekels are used in the West Bank and Gaza.

Begin, Rabin to appear on new Israeli bills

The images of the late Israeli Prime Ministers Menachem Begin and Yitzhak Rabin will appear on new Israeli currency.\n

As U.S. dollar plummets, Israelis rediscover the shekel

No longer the subject of derision or victim of hyperinflation, the shekel is now among the strongest currencies in the world. For the first time in years, businesses and real estate agencies that once dealt only in dollars are now instead setting their rates to the shekel.

Falling dollar forces groups to adjust overseas spending

While economists fret over how the falling U.S. dollar will affect global markets, Jewish charities that rely heavily on U.S. fundraising to support programs outside the United States are facing serious budget crunches.

New Articles

LA Congresswoman Sydney Kamlager-Dove Votes Against Resolution Declaring “From the River to the Sea” Is Antisemitic

ADL: Antisemitic Incidents Increased 140% Last Year

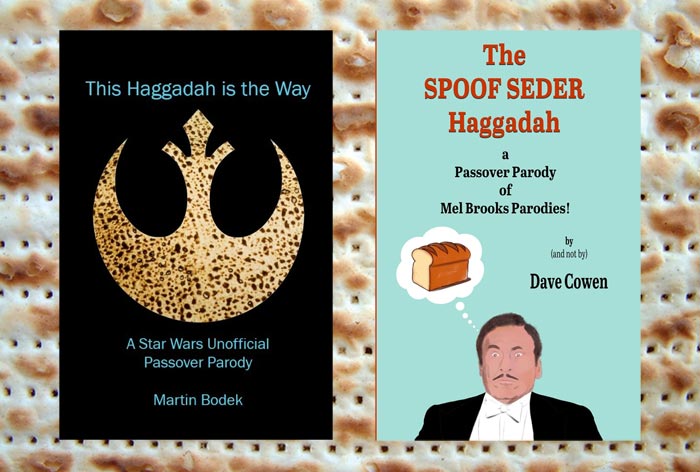

Fun Haggadot for Passover

UC Berkeley Law School Dean Talks About Antisemitism on Campus

More news and opinions than at a Shabbat dinner, right in your inbox.

More news and opinions than at a Shabbat dinner, right in your inbox.