On March 11, Paul S. Nussbaum trudged down the driveway in

his bathrobe, picked up the Los Angeles Times and headed back into his house —

part of his early morning routine. Moments later his wife handed him a fruit

protein shake, he cracked open the paper and pulled out the business section.

Nussbaum was “astounded and dumbfounded” by what he saw.

Under a headline that read, “Wells Refuses Belgium Claim,” Nussbaum learned

that Wells Fargo & Co. said it would not contribute $267,000 to a war

reparations fund for Belgian Jews, making it the only financial institution of

22 banks named in the $59 million settlement to balk at paying. Wells Fargo

argued that it had no legal obligation, because it had inherited the liability

through its acquisition of a small Belgium bank.

For Nussbaum, the son of two Holocaust survivors, the bank’s

actions came as a double shock. For one thing, Wells Fargo had cultivated a

great deal of good will in the Jewish community by contributing hundreds of

thousands of dollars to the Simon Wiesenthal Center, Jewish Family Service

(JFS) and other Jewish organizations. For another, Nussbaum, 46, is senior vice

president for Wells Fargo in Beverly Hills.

Turning to his wife, Nussbaum said: “The bank has done

something incredibly stupid that I have to deal with.”

And he did.

A day later, after a barrage of calls by Nussbaum to senior

executives at Wells Fargo and Jewish leaders, the bank said it would pay the

reparations. In a statement, Wells Fargo Chief Executive Dick Kovacevich

apologized to the Jewish community and called the Holocaust “the worst form of

discrimination and violation of human rights.”

The bank’s quick reversal probably minimized long-term

damage to its business interests and reputation. It also reflected the

crisis-management skills of Nussbaum, a Jewish philanthropist who has spent

much of his corporate career guiding organizations through roiled waters.

Although they sometimes cause him sleepless nights and an

upset stomach, difficult times bring out Nussbaum’s most analytical and

creative side, he said. Like a general calmly barking orders as bullets whiz

by, Nussbaum said he becomes ever more focused in a crisis, when his

“just-fix-it” personality kicks in.

During his career, he has helped clean up the portfolio of a

faltering savings in loan, put in 80-hour weeks to help Orange County tame its

budget to emerge from bankruptcy and single-handedly revived Wells Fargo’s

regional commercial banking office on the Westside.

In 1984, Nussbaum joined American Savings & Loan, just

as panicky investors had withdrawn $6.8 billion in one of the biggest bank runs

in history. Over the next five years, Nussbaum, working in conjunction with

then-American Savings CEO William J. Popejoy, helped the institution collect as

much as possible on its bad loans and remove them from the company’s books.

Nussbaum said his efforts saved taxpayers billions.

Later, he joined Wells Fargo. In 1995, the bank gave him a

paid leave so that he could serve as an adviser to his mentor Popejoy, then-CEO

of bankrupt Orange County. At first viewed suspiciously as a Popejoy lackey,

Nussbaum won over a lot of skeptics with his long hours and dedication toward

making the county solvent, experts said.

Nussbaum was part of a group of officials who slashed the

county’s budget 41 percent. Although Nussbaum left after only five months,

Popejoy said, “I don’t think anyone made a bigger contribution that helped the

county regain its footing. Paul was one of the unsung heroes.”

Four years ago, Wells Fargo asked Nussbaum to reopen a

commercial banking office in Beverly Hills that had been shuttered during an

earlier consolidation. Starting from scratch, he has built a team of 16 people

and increased by fourfold the number of Wells Fargo loans to Westside companies

and individuals.

“I think Paul has done an exemplary job of establishing us

in a market we had tried to break into in the past but had been largely

unsuccessful,” said Paul Watson, Wells Fargo head of commercial and corporate

banking. “He’s a good banker and very involved with the community. When you put

that together, you have a successful formula.”

Nussbaum’s commitment to business is matched only by his

community activism. A board member at JFS, the Wiesenthal Center and Stephen S.

Wise Temple, he has encouraged Wells Fargo to donate hundreds of thousands of

dollars to those and other groups, including $150,000 this year to JFS.

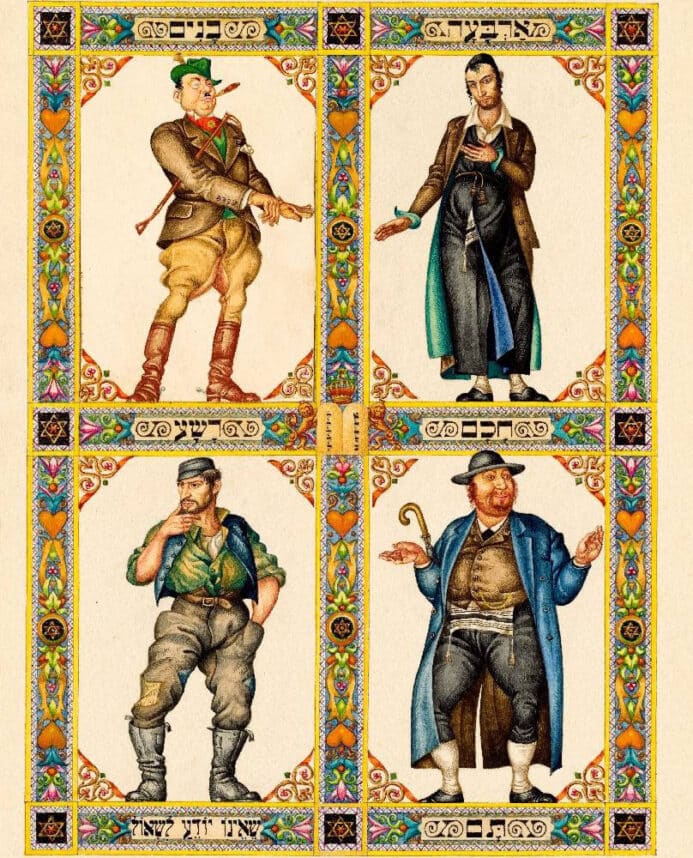

Mark Berns, past president of Stephen S. Wise, said Nussbaum

makes contributions to the temple, both big and small. Recently, Nussbaum volunteered

to cook food all afternoon “over hot flames and in the sun” at a Purim festival

that raised $40,000, Berns said.

Rabbi Marvin Hier, dean of the Wiesenthal Center, has known

Nussbaum for seven years. He said the banker’s efforts to coax Wells Fargo to

pay the reparations reflect Nussbaum’s deep commitment to Jewish values.

“I think he saved the bank a lot of heartache by making such

a big fuss,” Hier said. “He did the right thing.”

More news and opinions than at a Shabbat dinner, right in your inbox.

More news and opinions than at a Shabbat dinner, right in your inbox.